It can be defined as the net asset value of the firm or company that can be calculated as total assets, less intangible assets (goodwill, patents, etc.), and liabilities. Further, Book Value Per Share (BVPS) can be computed based on the equity of the common shareholders in the company. All other things being equal, a higher book value is better, but it is essential to consider several other factors. People who have already invested in a successful company can realistically expect its book valuation to increase during most years. However, larger companies within a particular industry will generally have higher book values, just as they have higher market values.

Formula to Calculate Book Value of a Company

They typically raise equity capital by listing the shares on the stock exchange through an initial public offering (IPO). Sometimes, companies get equity capital through other measures, such as follow-on issues, rights issues, and additional share sales. Companies with lots of real estate, machinery, inventory, and equipment tend to have large book values.

What Is Book Value Per Share?

The term “book value” is derived from accounting lingo, where the accounting journal and ledger are known as a company’s books. One of the major issues with book value is that companies report the figure quarterly or annually. It is only after xero community questions the reporting that an investor would know how it has changed over the months. NBV stands for “Net Book Value” and refers to the carrying value of an asset recognized on the balance sheet of a company, prepared for bookkeeping purposes.

What is your current financial priority?

For agency owners who want to gauge their agency’s value accurately, relying solely on guesswork or broad industry averages may not yield the insights needed for impactful decision-making. Valuing an insurance book of business is crucial for agency owners aiming to make informed decisions, whether they’re planning a sale, merger, or simply assessing the health of their agency. While understanding the true worth of your book of business might seem complex, having the right tools can simplify the process significantly.

It can offer a view of how the market values a particular company’s stock and whether that value is comparable to the BVPS. A company’s stock is considered undervalued when BVPS is higher than a company’s market value or current stock price. If the BVPS increases, the stock is perceived as more valuable, and the price should increase. The examples given above should make it clear that book and market values are very different. Many investors and traders use both book and market values to make decisions.

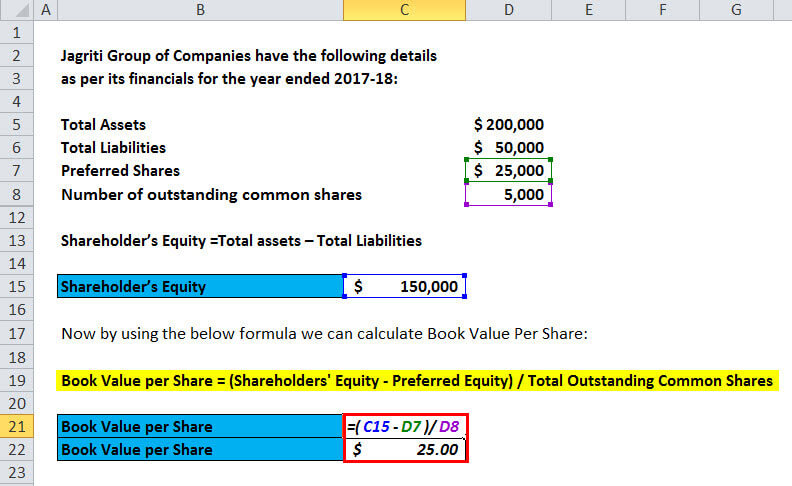

Book Value Formula

If a company is selling 15% below book value, but it takes several years for the price to catch up, then you might have been better off with a 5% bond. Finance Strategists has an advertising relationship with some of the companies included on this website. We may earn a commission when you click on a link or make a purchase through the links on our site. All of our content is based on objective analysis, and the opinions are our own. Suresh recently joined as an intern under Vivek and carried a passion for research. We are held to a higher standard for customer service, transparency and ethical business practices.

- Critics of book value are quick to point out that finding genuine book value plays has become difficult in the heavily-analyzed U.S. stock market.

- By calculating tangible book value we might get a step closer to the baseline value of the company.

- Like other multiple-based approaches, the trend in price/BVPS can be assessed over time or compared to multiples of similar companies to assess relative value.

- Deriving the book value of a company becomes easier when you know where to look.

- Hence, if an enterprise undergoes liquidation, the fair value prediction of assets clearly indicates that the owners (shareholders) cannot receive the net carrying value of assets.

It is important to predict the fair value of all assets when an enterprise stops its operations. Carrying value is calculated as the original cost of the asset less any depreciation, amortization, or impairment costs. Also, we can add Equity Share capital and Reserves to get shareholder’s equity which is 5,922 cr + 2,87,569 cr, which will sum to 2,93,491 cr. The following image shows Coca-Cola’s “Equity Attributable to Shareowners” line at the bottom of its Shareowners’ Equity section. In this case, that total of $24.1 billion would be the book value of Coca-Cola. It’s one metric that an investor may look for if they’re interested in valuating Coca-Cola as a potential investment.

It is unusual for a company to trade at a market value that is lower than its book valuation. When that happens, it usually indicates that the market has momentarily lost confidence in the company. It may be due to business problems, loss of critical lawsuits, or other random events. In other words, the market doesn’t believe that the company is worth the value on its books. Mismanagement or economic conditions might put the firm’s future profits and cash flows in question.

Book value does not always include the full impact of claims on assets and the costs of selling them. Book valuation might be too high if the company is a bankruptcy candidate and has liens against its assets. What is more, assets will not fetch their full values if creditors sell them in a depressed market at fire-sale prices. In effect, the carrying value of a fixed asset (PP&E) is gradually reduced, however, the stated amount on the balance sheet does not reflect its fair value as of the present date.

Transferring your insurance book of business involves navigating complex legal and compliance requirements. Whether selling or acquiring a book, it’s essential to understand the valuation, client consent, license transfers, non-compete agreements, data privacy laws, and insurance carrier approvals. Proper due diligence and legal guidance are critical to avoid penalties and disputes. Partner with Renegade Insurance for a seamless, compliant transition, leveraging our expertise in client retention. Transfer your book to Renegade Insurance for a seamless transition and witness remarkable results. Since four years have passed, whereby the annual depreciation expense is $1 million, the accumulated depreciation totals $4 million.