If you find your average realization rate over X number of transactions is 90%, then it’s reasonable to expect that any future transactions will also be around 90%. In the case of continuous services, it is to be recognized on a percentage completion basis. Solution – As per the Recognition principle, in the case of goods, revenue is to be recognized when all the risks and rewards related to the underlying asset are transferred. Last but not least, we recognize revenue when the performance obligation is satisfied either over time or at a point in time.

Long-term contracts

In other words, revenues are realized when you actually sell the shirt or car or any other good to a customer or perform some type of work, thereby causing either the receipt of money or the right to receive money or other assets. Despite the structure that ASC 606 brought, revenue recognition can still be undeniably nuanced, tedious, and complex at times, depending on the business model and other factors. Naturally, it poses some common business pitfalls, ranging from timing issues to complex contractual arrangements. It also impacts a company’s profitability, liquidity, and solvency, thus influencing its valuation and creditworthiness.

GAAP Supports Revenue Recognition Standards

- The realization concept is the idea that revenue should only be recognized when it is earned, which typically happens when goods or services are transferred to the buyer.

- For example, attorneys charge their clients in billable hours and present the invoice after work is completed.

- The company expects to receivepayment on accounts receivable within the company’s operatingperiod (less than a year).

- This distinction is crucial for maintaining the integrity and accuracy of financial reports, as it helps prevent the premature or delayed recording of revenues and expenses.

- In the subsequent years to, the price remains the same (minus depreciation charged).

Recognition, on the other hand, is the formal recording of these transactions in the financial statements. This step involves acknowledging that an economic event has occurred and that it should be reflected in the company’s books. Recognition is governed by specific accounting standards and principles, which dictate when and how transactions should be recorded.

AccountingTools

In the case of the realization principle, performance, and not promises, determines when revenue should be booked. However, even with these strategies in place, there is still potential for errors and inaccuracies in the financial reporting process. This is common in long-term construction and defense contracts that take years to complete. The revenue in these cases is considered earned at various stages of job completion.

The Revenue Realization Principle in Accounting

The going concern concept assumes that a business will continue to operate indefinitely. So it assumes that for the foreseeable future the business will not be winding up. This leads to the assumption that the business will not have to sell its assets any time soon and it will meet all its obligations as well. This article is not intended to provide tax, legal, or investment advice, and BooksTime does not provide any services in these areas.

Companies also frequently tailor their pricing, sales, and marketing strategies based on the information found in their financial reports. When executives are confident in their organization’s revenue recognition processes and reporting, they can make informed decisions in other business areas. By adhering to GAAP, companies present a true and fair view of their financial health to stakeholders, including investors, creditors, and regulators. Proper revenue recognition affects the income, balance, and cash flow statements.

The revenue realization principle is based on the revenue recognition principle — that is, that revenue is only recognized when it has been earned, regardless of whether payment has been received or not. As an example, let’s say a company sells a product for $100 and receives payment immediately. If, however, they received payment in installments over a period of time, the revenue would only be realized as each installment is paid. In case of the rendering of services, revenue is recognized on the basis of stage of completion of the services specified in the contract.

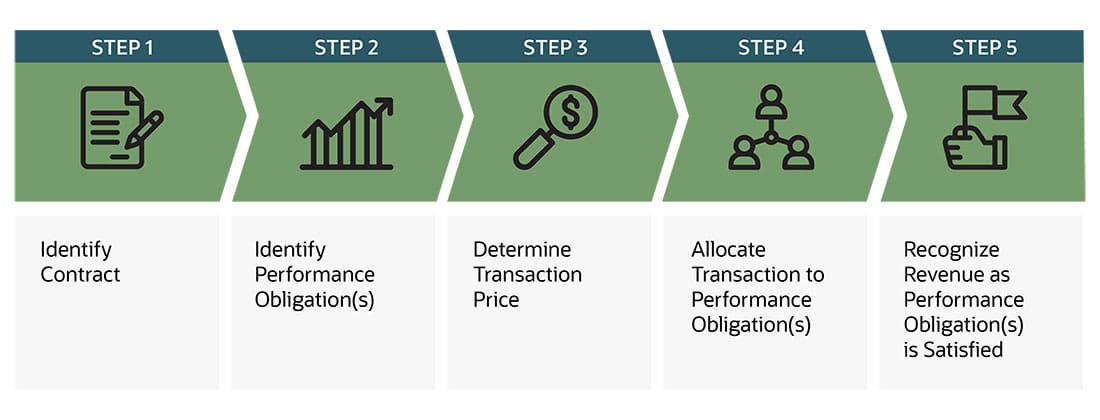

ASC 606 streamlined the whole process, making it the same for everyone who enters into contracts with customers. The realization concept has been a part of financial reporting for many years, but the principles have changed over time. tax calculator return and refund estimator 2020 In order to stay up to date with the latest accounting standards, companies must be aware of these changes and apply them accordingly. The revenue recognition principle is a key part of generally accepted accounting principles (GAAP).